|

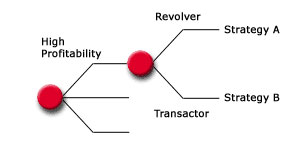

Combating silent attrition in the credit card industry Transforming data into actionable knowledge Copyright ©2001 All rights reserved Marketing departments at credit card companies know this problem too well. Too many of the best customers stop using their cards each year and don’t call you to tell you so. That’s what silent attrition means. Noisy attrition, on the other hand, is easier to deal with. At least when a customer calls to close their account you get the chance to respond. But what about the case when a profitable customer who has been with you for years just stops using your card? Wouldn’t it be great if only the least profitable customers departed? Wishful thinking. Wouldn’t it be great if the most profitable customers were required to give you 60 days notice before departing? Not a chance. Wouldn’t it be great if you could predict who was about to jump ship? Good news. You can. Credit card companies have access to gigantic amounts of data. Some companies have done a better job than others organizing that data and having it readily accessible. If you’re one of the companies that have, then double kudos to you. You’re halfway there. The most important thing you can do is to identify your customer. And I’m not talking about their first names. Before we start, answer these questions: • How do I define profitability? • Who are my most profitable customers? • Who are my least profitable customers? • If I knew that a profitable customer was leaving, do I have strategies that will convince them to stay? Developing a profitability score is critical. You most probably have a set budget for retention and you want to use those dollars wisely. In addition, there are actually customers who you wouldn’t want to spend resources on trying to retain. You can then proceed to segment your customers according to their score. Typically, you might find three types of customers and should set a different strategy for each segment. The following table is a sample of a simple segmentation design:

Of course, strategies are more complex. Segmenting the population further with attributes such as revolver, transactor, etc will lead to better results.

Building an Attrition Model (see the article 11 Steps to Building a Predictive Model By Randall T Smith, Peak Data Solutions, Inc., April 10, 2000.) Developing a predictive model is both an art and a science. Knowing which variables to use and how strategies will be implemented is important. The following are simple examples of possible attrition cases: Example1 Example 2 Conclusion

|

||||

| Request Brochures/More Information: | ||||

|

||||

| * Requires the Adobe Acrobat Reader Plug-In |